Introduction

In the modern business landscape, Environmental, Social, and Governance (ESG) criteria have become essential for driving sustainable practices. As companies strive to meet stakeholder expectations, ESG principles are increasingly integrated into corporate strategies. These principles help businesses minimize their negative impact on the environment and society while positioning them as leaders in ethical governance.

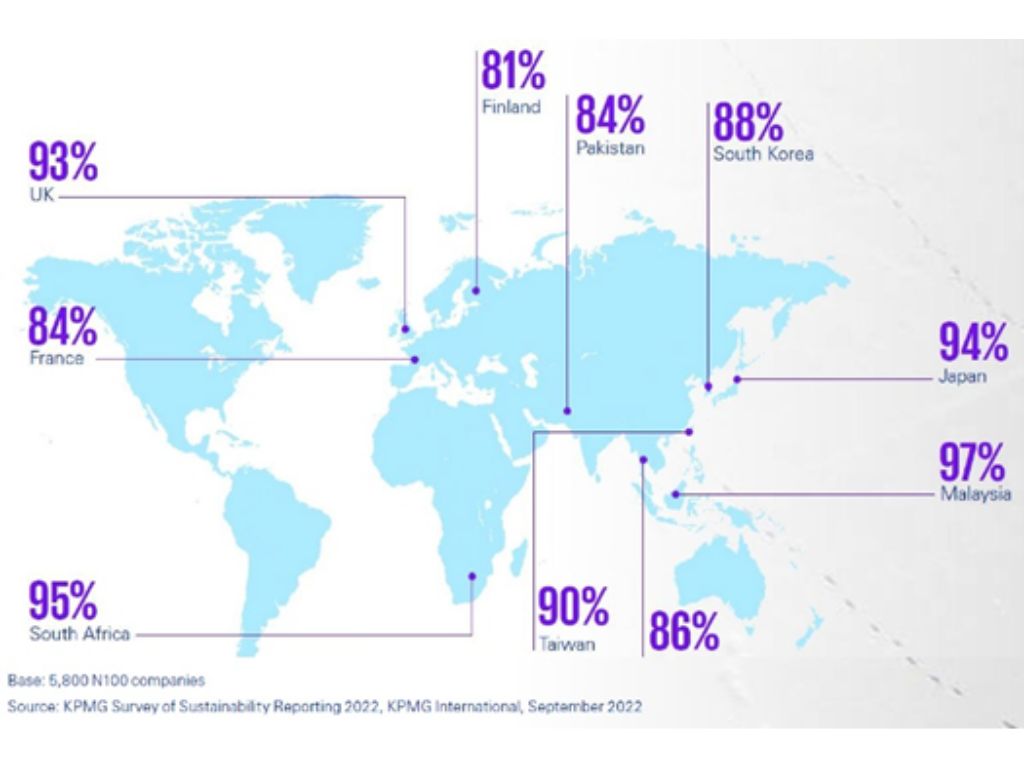

Globally, ESG has become a critical factor in many sectors such as oil and gas, energy, transportation, manufacturing, tourism, and construction. A Deloitte survey found that 81% of global companies have published ESG reports, with many integrating these factors into their strategic decision-making processes, indicating widespread adoption among large corporations [1]. According to PwC’s research, 94% of the top 50 listed companies in Malaysia had ESG strategies and 68% had emissions reduction policies as of December 2021 [2]. In 2022, 97% of Malaysia’s Top 100 companies include sustainability data in their annual reports according to KPMG’s Survey of Sustainability Reporting 2022 as shown in Fig 1. [3].

(source: KPMG Survey of Sustainability

Reporting, 2022)

Fig

1. Top 10 countries,

territories and jurisdictions by percentage of N100 companies that includes

sustainability information in annual financial reports 2022

Understanding the ESG in business

ESG in business refers to the operation performances in Environmental, Social, and Governance. These three pillars represent the key areas where businesses can make a positive impact:

1. Environmental

Efforts in improving

environmental performance, such as reducing carbon emissions, energy

management, waste management, water quality, and resource efficiency. Companies

are increasingly focusing on renewable energy, sustainable sourcing, and

emissions reduction.

2. Social

This pillar covers issues

including cybersecurity, customer privacy, employee benefits, occupational

safety, corporate social responsibility (CSR), community engagement, and human

rights. Companies work to ensure fair treatment of employees, support local

communities, and promote diversity and inclusion.

3. Governance

Involves structures and

processes for decision-making, accountability, and transparency. Good

governance practices include ethical business conduct, robust risk management,

and transparent reporting.

ESG Adoption in Sarawak

Sarawak has seen an increasing number of companies incorporating ESG principles into their operations, including in the palm oil, timber, oil and gas, energy, and transportation industries. Businesses are investing in environmental initiatives to reduce their ecological impact, such as adopting sustainable land-use practices, promoting reforestation, and investing in renewable energy.

The Sarawak government has published Post-Covid-19 Development Strategy 2030 (PCDS 2030) to support environmental sustainability, balancing economic growth with conservation to ensure long-term ecosystem health. Besides, Initiatives like the Sarawak Corridor of Renewable Energy (SCORE) aim to attract investment in renewable energy and green industries, creating a sustainable economic future for Sarawak.

In addition, Sarawak is the first in Malaysia to pass a bill on carbon emissions, the LAWS OF SARAWAK, Environment (Reduction of Greenhouse Gases Emission) Ordinance, 2023 [4]. This initiative aims to achieve net-zero carbon emissions by 2050.

Advantages of Embedding ESG in Business

1. Attracting

and Retaining Investors

Investors are increasingly

considering ESG factors when making investment decisions. Sustainable investing

has gained traction, with investors seeking opportunities that align with their

values and provide long-term returns. Companies with good ESG performances are

perceived as lower-risk investments, as they are better equipped to handle

environmental and social challenges. Investment funds that prioritize ESG

criteria, such as socially responsible investment (SRI) funds and green bonds,

are attracting significant capital. Companies that demonstrate a commitment to

sustainability can access a broader pool of investors and benefit from enhanced

capital flows.

2. Improving

Operational Efficiency and Cost Savings

Implementing ESG practices in

business can significantly improve their operational efficiency and cost

savings. By optimizing resources use, reducing waste, and enhancing energy

efficiency, companies can reduce operational costs and improve their weakness,

and thus increase the sustainability of the business. For example,

energy-efficient technologies and waste reduction initiatives can lead to

significant savings in utilities and waste disposal expenses. Moreover,

sustainable supply chain practices can enhance operational resilience and

reduce disruptions. Companies that prioritize ethical sourcing and responsible

supplier relationships can mitigate risks and ensure the continuity of their

operations.

3. Enhancing

Corporate Reputation and Branding

Beyond Corporate Social

Responsibility (CSR), ESG practices can significantly enhance a company’s image,

reputation and branding by showing its strong commitment to sustainability and

ethical governance. This attracts eco-conscious consumers and investors, builds

trust, and helps the business stand out in a competitive market. For example,

companies that actively reduce their carbon footprint and promote sustainable

products often receive favorable attention from environmentally conscious

consumers. As a result, it leads to stronger brand loyalty, better customer

retention, and a positive reputation that drives long-term success.

4. Driving

Innovation and Competitive Advantage

ESG principles encourage

companies to innovate and develop sustainable solutions. By focusing on

environmental and social challenges, businesses can identify new market

opportunities and create products and services that address societal needs.

Innovation driven by ESG considerations can lead to the development of

eco-friendly products, renewable energy technologies, and circular economy

initiatives. Sustainable innovation provides a competitive advantage by

allowing companies to differentiate themselves from competitors and meet the

growing demand for sustainable solutions. Businesses that lead in

sustainability innovation are better positioned to capture market share and

drive long-term growth.

5. Mitigating

Risks and Ensuring Resilience

ESG practices play a

crucial role in risk management and resilience building. Companies that address

environmental and social risks are better prepared to navigate challenges such

as regulatory changes, climate-related events, and reputational crises. By

proactively managing risks, businesses can reduce potential liabilities and

ensure long-term stability. For instance, companies that assess climate risks

and implement adaptation strategies can protect their assets and operations

from climate-related impacts. Besides, those that prioritize social

responsibility and stakeholder engagement can build stronger relationships and

reduce the risk of social conflicts.

6. Fostering

Employee Engagement and Talent Attraction

A strong ESG focus can

enhance employee engagement and attract top talent. Employees increasingly seek

to work for companies that align with their values and contribute positively to

society. Businesses that prioritize diversity, inclusion, and employee

well-being create a positive work environment and foster a sense of purpose

among their workforce. Engaged employees are more productive, innovative, and

committed to their organizations. By attracting and retaining talented

individuals, companies can enhance their human capital and drive sustainable

business success.

Fig 2. Advantages of Embedding ESG in Business

Measuring and Reporting ESG Performance

Accurate measurement and reporting of ESG performance are essential for transparency and accountability. However, defining and quantifying ESG metrics can be complex, given the diversity of industries and sustainability factors. Companies need to develop standardized methodologies for measuring ESG impacts and reporting progress.

Sustainability reporting frameworks, such as the Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosure (TCFD), Sustainability Accounting Standards Board (SASB), and BURSA Sustainability Reporting Guide, provide guidelines for consistent and transparent ESG reporting. By adopting these frameworks, businesses can enhance their credibility and build trust with stakeholders.

Challenges & Opportunities

While the adoption of ESG principles in Sarawak is gaining momentum, there are still challenges to overcome. One of the main challenges is the lack of awareness and understanding of ESG among some businesses. There is a need for more education and training to help companies integrate ESG into their operations effectively. Additionally, there are challenges related to the enforcement of ESG standards and the monitoring of compliance.

Despite of these challenges, the Sarawak’s abundant natural resources offer opportunities for sustainable growth as follows:

Sustainable Economic Growth: Embracing ESG principles presents significant opportunities for sustainable economic growth in Sarawak. By investing in renewable energy, eco-tourism, and sustainable agriculture, the region can diversify its economy and create green jobs.

Global Market Access: Companies that adopt ESG practices are better positioned to access global markets and attract investment. Increasing consumer demand for sustainable products and services presents opportunities for businesses to differentiate themselves and gain a competitive advantage.

Carbon Credit Investment: Investing in Exchange-Traded Funds (ETFs) focused on carbon credits provides exposure to the carbon market and diversifies risk across various credit-generating projects. Engaging with carbon trading platforms that specialize in carbon credits allows for direct participation in the market dynamics and price fluctuations.

Grants Opportunities: An MOU signed between InvestSarawak, UNGCMYB, and Alliance Bank in November 2023, to extend RM1 billion in green financing to Sarawak SMEs that adopt sustainable practices. Deputy Premier Datuk Amar Awang Tengah Ali Hasan stated the funds aim to enhance sustainable-trade readiness and ESG compliance [5].

In addition, Malaysia Investment Development Authority introduced the Domestic Investment Accelerator Fund (DIAF) in March 2024 to support Malaysian-owned Small and Medium Enterprises (SMEs) and Mid-Tier Companies (MTCs) in the manufacturing and selected services sectors (such as Hotel & Tourism, Private Healthcare, Oil & Gas, Logistics, etc.) for the transition into ESG practices [6].

Conclusion

ESG is emerging as a powerful catalyst for sustainable business. Sarawak, with its rich green resources and the growing number of companies adopting ESG principles, highlights the potential for sustainable development. The Sarawak government has demonstrated great ambition in pursuing continuous economic growth and a green, sustainable future. By integrating ESG into their strategies, businesses in Sarawak can drive positive environmental and social impact, while ensuring long-term economic success. As more companies embedding ESG in their businesses, the vision of a sustainable and prosperous future for Sarawak becomes increasingly attainable.

References

[1] Deloitte (2022). Sustainability action report: Survey findings on ESG disclosure and preparedness. Retrieved on July 28, 2024 from https://www2.deloitte.com/content/dam/Deloitte/us/Documents/audit/us-survey-findings-on-esg-disclosure-and-preparedness.pdf?trk=public_post_comment-text

[2] The Edge Malaysia (2022). Keeping the recovery momentum by building long-term resilience, prioritising sustainability. Retrieved on July 28, 2024 from https://theedgemalaysia.com/article/keeping-recovery-momentum-building-longterm-resilience-prioritising-sustainability

[3] KPMG (2022). KPMG biennial Survey of Sustainability Reporting 2022. Retrieved on 28 July, 2024 from https://assets.kpmg.com/content/dam/kpmg/sg/pdf/2022/10/ssr-small-steps-big-shifts.pdf

[4] Borneo Post Online (2023). Sarawak first state to pass law on carbon emissions. Retrieved on 28 July, 2024 from https://www.theborneopost.com/2023/11/21/sarawak-first-state-to-pass-law-on-carbon-emission/

[5] Dayak Daily (2023). Tripartite MoU signed to extend RM1 bln green financing for Sarawakian SMEs. Retrieved on July 28, 2024 from https://dayakdaily.com/tripartite-mou-signed-to-extend-rm1-bln-green-financing-for-sarawakian-smes/

[6] MIDA (2023). Malaysia Launches New Funds

to Drive Automation, Digitalisation, and Sustainable ESG Practices. Retrieved

on July 28, 2024 from https://www.mida.gov.my/media-release/malaysia-launches-new-funds-to-drive-automation-digitalisation-and-sustainable-esg-practices/

Fig 3. Curtin Malaysia organized ESG workshop for organisations interested in ESG accreditation in Oct 2022.

Fig 4. MOU Signing Ceremony between Curtin Malaysia & ESG Malaysia on 15th May 2023.

Fig 5. Curtin Malaysia delegate, Dr.Leong Kong Yong (1st left) participated World ESG Summit in 2023.

Fig 6. ESG Club and ESG Hub established at Curtin Malaysia to foster sustainable practices in May 2023.

Fig 7. Curtin Malaysia hosts Sustainability Event for students and public in collaboration with professional body in Sep 2023.